Impact saint patrick high school today and tomorrow

Your charitable gift will provide vital support for our projects, activities and goals

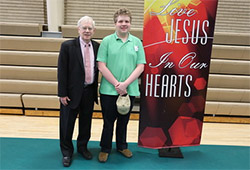

Art Hoffmann '59 is a practicing CPA who is proud that his grandson Matty Lewis '16 also is a Shamrock. He expects that another grandson will become a Shamrock next year.

As a CPA who is over 70 1/2, Art knew that it would be tax advantageous for him to use all or part of his required minimum distribution (RMD) to make a gift, up to $100,000 per year, directly from his IRA to Saint Patrick High School. Art called his IRA plan administrator and directed that a generous amount of his RMD be paid from his IRA direct to St. Pat's.

According to Art, "It was great to be able to transfer money directly from my IRA to St. Pat's. The fact that my gift qualified as part of my required minimum distribution and was excluded from my taxable retirement income was an additional bonus! Maybe best of all was the satisfaction I felt knowing that I had helped to make tuition more affordable for St. Pat's students."

5900 West Belmont Avenue, Chicago, IL 60634

© Copyright 2024 Crescendo Interactive, Inc. All Rights Reserved.

PRIVACY STATEMENT

This site is informational and educational in nature. It is not offering professional tax, legal, or accounting advice. For specific advice about the effect of any planning concept on your tax or financial situation or with your estate, please consult a qualified professional advisor.

Certain Design/Style Elements: © Copyright Idea Marketing Group